When you’re just starting your investment journey, or simply looking for an effortless way to grow your money, Acorns often pops up on the radar. It promises to turn your spare change into a robust investment portfolio, but the big question on everyone's mind is: what about Acorns investment performance and returns? Can those small, consistent contributions actually amount to something significant, or is it just another digital piggy bank?

As someone who’s seen countless investment apps come and go, I can tell you that "good" performance isn't a one-size-fits-all answer. It depends heavily on your goals, your timeline, and what you’re comparing it against. But let's unpackage Acorns' approach and see how it truly stacks up.

At a Glance: Acorns Performance in a Nutshell

- Diverse Portfolios: Acorns offers five expert-built portfolios ranging from Conservative (100% bonds) to Aggressive (100% stocks), plus a Custom Portfolios option.

- ETF-Based: Investments are made into low-cost, index-based Exchange Traded Funds (ETFs) from providers like Vanguard and iShares.

- Automatic & Passive: Features like Round-Ups, recurring investments, automatic rebalancing, and dividend reinvesting automate the growth process.

- Market-Dependent: Returns largely mirror the performance of the underlying market indices the ETFs track. No active stock picking here.

- Long-Term Focus: Designed for growth over many years, leveraging the power of compound interest. Short-term fluctuations are normal.

- Potential for Growth: With a suitable portfolio and consistent contributions, Acorns can deliver market-average returns, which historically have been substantial over the long run.

Understanding the Acorns Investment Philosophy

Before we dive into numbers, it’s crucial to grasp the philosophy behind Acorns. This isn't a platform promising to make you an overnight millionaire by picking the next hot stock. Instead, Acorns focuses on two powerful, time-tested investment principles:

- Automation & Consistency: By rounding up your spare change and allowing for recurring deposits, Acorns makes saving and investing habitual and painless. This combats procrastination, which is often the biggest hurdle to financial growth.

- Diversification & Low-Cost Index Investing: Your money isn't put into individual stocks that could make or break your portfolio. Instead, Acorns invests in broad, low-cost Exchange Traded Funds (ETFs). These ETFs hold hundreds, sometimes thousands, of underlying stocks or bonds, giving you instant diversification across various companies, industries, and even countries.

Think of it like this: instead of trying to pick the winning horse in a race, Acorns invests in the entire racetrack. This strategy aims to capture the overall growth of the market, which historically has been far more reliable than trying to beat it.

The Building Blocks: What You're Actually Investing In

Acorns builds its portfolios using ETFs from highly reputable providers such as Vanguard and iShares. These aren't obscure, risky assets; they're the same types of funds many seasoned investors use.

For instance, your portfolio might include:

- Vanguard 500 Index Fund ETF (VOO): Tracks the performance of the 500 largest U.S. companies (the S&P 500).

- Vanguard Small-Cap ETF (VB): Gives you exposure to smaller U.S. companies.

- Vanguard FTSE Developed Markets Index Fund ETF (VEA): Invests in companies in developed countries outside the U.S.

- Vanguard REIT ETF (VNQ): Focuses on Real Estate Investment Trusts (REITs), which are companies that own, operate, or finance income-producing real estate.

- iShares 1-3 Year Treasury Bond ETF (SHY) & iShares iBoxx $ Investment Grade Index ETF (LQD): These provide exposure to various types of bonds, offering stability.

Some portfolios may even include a Bitcoin-linked ETF, introducing a small allocation to digital assets for those interested in that exposure. The mix of these underlying assets is what defines each of Acorns' pre-built portfolios.

Decoding Acorns' Expert-Built Portfolios: Risk vs. Reward

Acorns offers five core portfolios, each designed with a specific risk tolerance and potential return profile in mind. Understanding these is key to evaluating their performance for you.

1. Conservative: 100% Bonds

- Composition: Entirely composed of bond ETFs (e.g., short-term U.S. Treasuries, investment-grade corporate bonds).

- Performance Expectation: Lowest growth potential, but also the lowest risk of significant loss. Bonds typically offer modest, steady returns and act as a hedge during stock market downturns.

- Who it's for: Investors with a very low risk tolerance, those nearing retirement, or those saving for a short-term goal (less than 3-5 years).

2. Moderately Conservative: 40% Stocks / 60% Bonds

- Composition: A significant allocation to bonds for stability, with a smaller portion in stock ETFs for growth.

- Performance Expectation: Balances moderate growth with relative stability. You'll participate in some stock market gains but be cushioned during downturns.

- Who it's for: Those who want more growth than a pure bond portfolio but are still uncomfortable with significant market volatility.

3. Moderate: 60% Stocks / 40% Bonds

- Composition: A balanced approach, leaning slightly more towards stocks. This is often considered a traditional "balanced" portfolio.

- Performance Expectation: Aims for healthy growth over the long term, with some protection from bond exposure. It’s expected to perform in line with general market averages over time.

- Who it's for: Many typical investors aiming for long-term growth (5+ years) who can tolerate average market fluctuations.

4. Moderately Aggressive: 80% Stocks / 20% Bonds

- Composition: Heavily weighted towards stock ETFs, with a small bond allocation for a touch of stability.

- Performance Expectation: Higher growth potential, but also higher volatility and risk of larger drops during market corrections. This portfolio is designed to capture more of the stock market's upward momentum.

- Who it's for: Investors with a higher risk tolerance and a longer investment horizon (10+ years) who are comfortable riding out market ups and downs.

5. Aggressive: 100% Stocks

- Composition: Entirely composed of stock ETFs, including U.S. large-cap, small-cap, international, and sometimes sector-specific (like REITs, which can be up to 30% in this portfolio).

- Performance Expectation: Highest growth potential, but also the highest risk. This portfolio will experience the full force of market fluctuations, both up and down.

- Who it's for: Young investors with a very long time horizon (20+ years), high risk tolerance, and those who understand that significant short-term losses are possible in pursuit of maximum long-term gains.

A Note on REITs and Emerging Markets:

Acorns' portfolios include exposure to Real Estate Investment Trusts (REITs) and emerging markets. While these are intended to offer diversification, it's worth noting that REITs, though distinct, often correlate with broader stock market movements. Emerging markets add a layer of higher risk/higher reward potential. These are generally good long-term diversification strategies, but they can add to volatility.

What Drives Acorns' Returns? Key Performance Factors

Acorns doesn't generate returns out of thin air. Its performance is directly tied to several external and internal factors:

1. Market Performance: The Dominant Force

This is the biggest factor. Since Acorns invests in ETFs that track major market indices, its returns will largely mirror what those indices do.

- If the S&P 500 (represented by ETFs like VOO) has a great year, your stock-heavy Acorns portfolio will likely have a great year.

- If the bond market is struggling, your bond-heavy portfolio might see muted returns or even slight declines.

Acorns provides access to the market, but it cannot control the market. Your returns will reflect the general economic climate and stock/bond market trends.

2. Your Portfolio Choice: Risk Tolerance in Action

The riskier your chosen portfolio (e.g., Aggressive), the higher your potential for returns, but also for losses. A Conservative portfolio, by design, will have lower returns but also less volatility. The best "performing" portfolio isn't always the one with the highest percentage gain; it's the one that aligns with your comfort level and financial goals.

3. Time Horizon and Compound Interest: The Long Game Advantage

Investing with Acorns, especially with small, regular contributions, is a long-term strategy. The real magic happens with compound interest, where your earnings start earning their own returns.

- Example: Imagine you invest $100 and earn 10%. You now have $110. The next year, you earn 10% on $110, not just your original $100. Over decades, this snowball effect is incredibly powerful.

- Takeaway: Don't judge Acorns' performance over weeks or months. Think in years, or even decades, to truly see the benefit of compounding.

4. Dollar-Cost Averaging: Smoothing Out the Ride

Acorns' core mechanism – Round-Ups and recurring investments – is a perfect example of dollar-cost averaging. This means you invest a fixed amount regularly, regardless of market highs or lows.

- When prices are high, your fixed amount buys fewer shares.

- When prices are low, your fixed amount buys more shares.

- Over time, this strategy averages out your purchase price and reduces the risk of trying to "time the market" (which is notoriously difficult, even for pros).

This consistent buying helps mitigate the impact of market volatility on your overall returns.

5. Automatic Rebalancing & Dividend Reinvestment: Passive Optimization

Acorns handles the tedious but important tasks:

- Automatic Rebalancing: If your portfolio drifts from its target allocation (e.g., stocks grow much faster than bonds, making your 60/40 portfolio effectively 65/35), Acorns will automatically sell some of the overperforming assets and buy more of the underperforming ones to bring it back into balance. This happens quarterly if allocations are more than 5% out of balance. This discipline helps maintain your desired risk level.

- Automatic Dividend Reinvesting: When the ETFs in your portfolio pay out dividends, Acorns automatically reinvests them by buying more shares. This supercharges compounding and contributes significantly to long-term returns.

These features ensure your portfolio stays on track without you needing to lift a finger, which is a huge advantage for hands-off investors.

6. Fees: A Small Drag on Returns

While Acorns uses low-cost ETFs, the platform itself charges a monthly subscription fee (e.g., $3, $5, or $9 per month, depending on your plan). For very small balances, these fees can eat into returns significantly.

- Consider this: If you have $100 invested and pay $3/month, that's a 3% monthly fee, or 36% annually, before any market movement.

- The tipping point: As your balance grows, the fees become a smaller percentage of your total assets, making less of an impact on your overall performance. This is why many financial experts suggest that for Acorns to truly be worth it, you should aim for a higher balance."

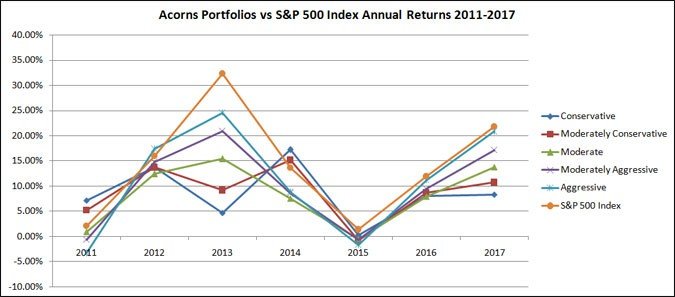

Measuring Success: How Acorns' Performance Stacks Up

It's tempting to ask, "What is Acorns' average return?" But that's like asking "What's the average speed of a car?" It depends on the model, the driver, and the road.

Instead, let's look at how Acorns compares in terms of strategy and what that implies for returns.

Against Individual Stock Picking

- Acorns: Aims for market-average returns through diversification. Lower risk, less potential for "home runs," but also far less potential for catastrophic losses.

- Individual Stock Picking: High risk, high reward (or high loss) potential. Requires significant research, emotional discipline, and often leads to underperformance for most amateur investors.

Verdict: Acorns offers a vastly more reliable path to wealth building for the vast majority of people who aren't professional traders. Its performance is designed to be consistent with broad market movements, not to beat them through speculation.

Against Other Robo-Advisors

Most robo-advisors (like Betterment, Wealthfront) follow a similar philosophy: diversified portfolios of low-cost ETFs, automatic rebalancing, and dividend reinvesting.

- Key Differences: Fee structures, specific ETF choices, and additional features (e.g., tax-loss harvesting, human advisor access).

- Performance: Generally, the investment performance of a Moderately Aggressive Acorns portfolio will be similar to a comparable Moderately Aggressive portfolio from another robo-advisor, as they all draw from the same underlying market performance. The differences usually come down to fees and slight variations in asset allocation.

Against DIY Index Investing

If you were to open an account with a brokerage like Vanguard or Fidelity and buy the exact same ETFs Acorns uses, your investment performance before fees would be identical.

- Acorns' Value: Convenience, automation (Round-Ups!), portfolio construction, and rebalancing.

- DIY Value: Lower fees (no monthly subscription, just expense ratios of the ETFs).

- Verdict: If you're comfortable choosing your own ETFs, setting up recurring investments, and manually rebalancing, DIY investing will likely yield slightly better net returns due to lower fees. However, Acorns removes the friction and cognitive load for those who prioritize simplicity. For many, the mental ease makes Acorns worth it despite the fees.

The "Good Enough" Standard

For many investors, especially those just starting, the goal isn't to "beat the market" every year. It's to participate in market growth, build wealth consistently, and reach financial goals. Acorns excels at this.

Its performance is "good enough" if it:

- Keeps you consistently invested.

- Aligns with your risk tolerance.

- Helps you achieve your long-term financial objectives.

Historically, diversified portfolios of stocks and bonds have delivered substantial returns over periods of 10+ years. Acorns provides a simple, accessible way to tap into that historical performance.

Custom Portfolios: Taking More Control (and What it Means for Performance)

Acorns offers a "Custom Portfolios" tool that allows you to allocate up to 50% of your total investment to individual stocks or ETFs you choose, complementing the expert-built "Base Portfolio."

- Pros for Performance: If you have high conviction in certain companies or sectors, this allows you to potentially amplify your returns beyond the general market, should your picks perform well.

- Cons for Performance: This also introduces individual stock risk. If your chosen stocks underperform, they could drag down your overall portfolio's returns, even if your underlying Acorns Base Portfolio is doing well. It requires more research and attention from you.

- Strategy: Use Custom Portfolios judiciously. Keep your core Acorns portfolio diversified and consider custom additions as a smaller, supplementary portion of your overall investment strategy.

Common Questions About Acorns Performance & Returns

Let's address some of the most frequent performance-related questions.

"What's the average return I can expect with Acorns?"

There's no single "average" return for Acorns because it depends on your chosen portfolio and market conditions. However, over long periods (10+ years):

- Aggressive (100% Stocks): Historically, a diversified stock portfolio has averaged around 8-10% annually (before inflation) over several decades, though with significant year-to-year variability.

- Moderate (60% Stocks / 40% Bonds): Historically, these balanced portfolios have averaged closer to 6-8% annually.

- Conservative (100% Bonds): Typically 3-5% annually, depending heavily on interest rates.

These are historical averages; past performance is not indicative of future results. Your actual returns will vary significantly.

"Can I lose money with Acorns?"

Yes, absolutely. Investing inherently carries risk. Since Acorns invests in publicly traded ETFs, the value of your investments will fluctuate with the market. If the stock market (or bond market, depending on your portfolio) goes down, the value of your Acorns portfolio will also go down. This is particularly true for stock-heavy portfolios. While your accounts are SIPC-protected up to $500,000 against brokerage failure, this does not protect against market losses.

"How often should I check my Acorns returns?"

For most long-term investors, checking frequently (daily or weekly) can be detrimental to your peace of mind and lead to emotional decisions. Given Acorns' long-term, passive strategy, reviewing your performance quarterly or annually is usually sufficient. Focus on your contribution consistency rather than short-term market swings. The power of compounding takes time.

"What about inflation? Does Acorns beat it?"

Inflation erodes the purchasing power of your money. A key goal of investing is to achieve returns above the rate of inflation. Historically, diversified stock portfolios have done a good job of beating inflation over the long term. Bond portfolios might struggle to keep pace with higher inflation rates, though they still offer some protection compared to cash. By investing in growth-oriented assets, Acorns aims to help your money grow faster than the rate of inflation.

"Is Acorns tax-efficient?"

Acorns manages taxable investment accounts (Acorns Invest). When you sell investments for a profit, or receive dividends, these are generally taxable events. Acorns will send you tax documents (like 1099-DIV and 1099-B) annually. It's important to understand that changing your recommended portfolio also counts as selling and buying, which could trigger a taxable event. For tax advice, always consult a qualified tax professional.

Maximizing Your Acorns Returns: Practical Strategies

While Acorns automates much of the investment process, there are still steps you can take to optimize your potential returns and ensure it aligns with your financial goals.

1. Be Consistent: Leverage Round-Ups and Recurring Investments

This is the bedrock of Acorns' strategy. The more consistently you invest, even small amounts, the more you benefit from dollar-cost averaging and compounding. Don't underestimate the power of those tiny, regular contributions. Turn on Round-Ups, set up a weekly or monthly recurring deposit, and let it run.

2. Choose the Right Portfolio for Your Risk Tolerance and Timeline

Be honest with yourself about how much risk you can truly stomach. If market dips make you panic and want to sell, an Aggressive portfolio isn't for you, even if it has the highest potential return. A portfolio that helps you stay invested through thick and thin is always the "best" performing one. If you have a long time horizon (10+ years), you can typically afford to be more aggressive.

3. Think Long-Term, Not Short-Term

Resist the urge to constantly check your balance or react to daily market news. Acorns is a marathon, not a sprint. Focus on the big picture and the compounding effect over years and decades. Market downturns are opportunities to buy shares at a lower price, not reasons to sell.

4. Leverage Features Wisely

- Dividend Reinvestment: Ensure this is always enabled (it's typically the default) to supercharge your compounding.

- Custom Portfolios: If you use this feature, do so with research and understanding. Don't gamble 50% of your portfolio on a single speculative stock. Use it to complement your diversified base, not replace it.

- Acorns Later: If you're using Acorns for retirement, this account type (IRA) offers tax advantages that can significantly boost your net long-term returns compared to a taxable Invest account.

5. Understand and Account for Fees

As your balance grows, Acorns' fixed monthly fees become less impactful on your percentage returns. However, if you have a very small balance, the fees can be a significant drag. If your account is consistently small, evaluate if Acorns is worth it for you compared to alternative low-fee options. As your balance grows, the relative impact of the fixed fee diminishes greatly.

The Bottom Line: Is Acorns Right for Your Investment Journey?

So, are Acorns investment performance and returns any good? The answer is a resounding "yes," for the right investor, under the right conditions.

Acorns isn't designed to outperform the market; it's designed to get you into the market and help you participate in its historical growth in a simple, automated, and diversified way. Its performance directly reflects the market performance of well-regarded, low-cost ETFs.

- If you're someone who struggles to save, finds investing intimidating, or just wants a hands-off approach to wealth building, Acorns provides an excellent entry point. Its automated Round-Ups and recurring investments are incredibly effective at building consistent habits.

- If you have significant capital and are comfortable with a DIY approach to buying ETFs or want highly customized portfolio management with tax-loss harvesting, you might find other options with lower fees.

- But for the vast majority who need a nudge to start, a simple framework, and a commitment to long-term growth, Acorns offers a robust and effective path to harnessing the power of the market.

Ultimately, "good" performance is about meeting your goals. If your goal is consistent, diversified, and automated wealth accumulation over the long haul, Acorns has a proven strategy to deliver market-based returns and help you achieve it. Your best next step is to honestly assess your risk tolerance, choose the portfolio that fits, and then let time and consistency do the heavy lifting.